Montana Supreme Court says counties wrong on 95-mill tax issue

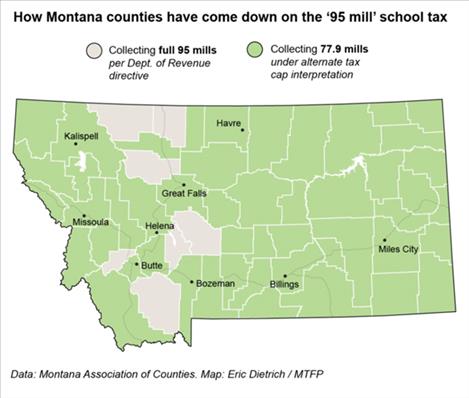

Ruling means 49 of 56 counties under-collected state school equalization dollars with property tax bills sent this fall.

Hey savvy news reader! Thanks for choosing local.

You are now reading

1 of 3 free articles.

The Montana Supreme Court Wednesday ruled against Montana county governments in a dispute over the Montana Department of Revenue’s authority to order the full collection of the 95-mill state-level school equalization levy, a formerly obscure piece of tax bills that became a flashpoint this fall as state and local officials contended with frustration over rising property taxes.

The ruling means that the 49 of 56 Montana counties that chose to collect a lower, 77.9-mill rate on tax bills sent to property owners this fall will likely have to make up the difference when they mail their next round of semi-annual tax bills in the spring.

“I’m amazed,” Beaverhead County Commissioner Mike McGinley said of the ruling, which was issued by justices the day before Thanksgiving. “I guess I’m going to have to donate this turkey and go get some crow.”

Rising property values meant the 95 mills, which fund part of a state effort to balance funding between tax-base-rich and tax-base-poor school districts, are expected to bring in about $99 million more this year than last, revenues that were baked into the budget passed by this year’s state Legislature.

The revenue department directed counties to collect the full 95 mills in September, interpreting the relevant tax law in the way it has for decades. McGinley and many other county officials, however, rallied around an interpretation of the tax code that, if it had been accepted by justices, would have limited the growth of the school equalization collections to the lower millage rate.

The county-backed rate would have reduced collections by about $80 million a year statewide, producing savings of roughly $104 a year for a home valued at $450,000.

McGinley and most other county officials have been adamant that, with the state General Fund relatively flush, the state could accommodate lower collections without hurting schools. Education advocates have worried, however, that reducing collections would force them to put a $160 million request for supplemental education funding before potentially skeptical lawmakers when the Legislature meets in 2025.

The dispute has produced at least four separate lawsuits filed before state district judges and the Montana Supreme Court. Wednesday’s Supreme Court ruling came in a case filed by the Montana Association of Counties and some individual officials against the state and the revenue department, which is run by a director appointed by Gov. Greg Gianforte.

Montana’s 1972 Constitution requires the state to provide the public with an education system that provides “[e]quality of educational opportunity.” The 95 mills, technically a bundle of multiple school taxes that are in some cases displayed separately on property tax bills, were adopted by the Legislature in an effort to meet that requirement.

In their 7-0 ruling, Supreme Court justices said they generally defer to state agencies like the Department of Revenue when questions arise about a law that agencies have consistently interpreted in a particular way for considerable lengths of time.

“DOR’s methodology has been untested for two decades, and its interpretation of the statute is consistent with the State’s constitutional directives,” Chief Justice Mike McGrath wrote on behalf of the majority.

Gianforte’s office and education advocates applauded the ruling Wednesday.

“Today’s decision reaffirms what has guided us: We have an obligation, both constitutional and moral, to ensure each Montana child has access to a quality education, and we won’t defund our public schools,” Gianforte said in a statement.

The governor also touted his administration’s efforts to offset rising taxes by offering property tax rebates of up to $675 a year this year and next. The property tax rebates are available to homeowners, but not to renters or commercial property owners.

Lance Melton, the director of the Montana School Boards Association, said in an interview that schools had “dodged a bullet” with the ruling. Melton also said he believed the ruling would preempt a lawsuit filed against county governments by the Montana Quality Education Coalition.

Montana Federation of Public Employees president Amanda Curtis, whose members include unionized teachers, said through a spokesperson that the ruling “protects our local schools from becoming collateral damage as Montanans grapple with the fallout from the Legislature’s failure to find long-term solutions to rising property taxes.”